Introduction

Turkey’s recent aggressive monetary maneuvers stand as a stark testament to the challenges of managing soaring inflation. Simultaneously, the innovative approach of Kinesis.money in offering blockchain-based financial solutions is drawing attention. This report delves into these two pivotal developments, highlighting their potential implications and synergies.

Turkey’s Bold Economic Measures

Turkey, grappling with rising inflation, has taken decisive action. The Central Bank’s substantial increase in interest rates, from 35% to a significant 40%, is a clear signal of its commitment to stabilizing the economy and bolstering the lira. This move is the latest in a six-month-long monetary tightening cycle, reflecting a relentless pursuit of economic stability. The bank’s strategy suggests a near-peak interest rate, aimed directly at curbing inflation. This approach is a critical step in the nation’s broader economic strategy, which seeks to balance growth with financial stability.

Kinesis.money’s Strategic Role in Turkey

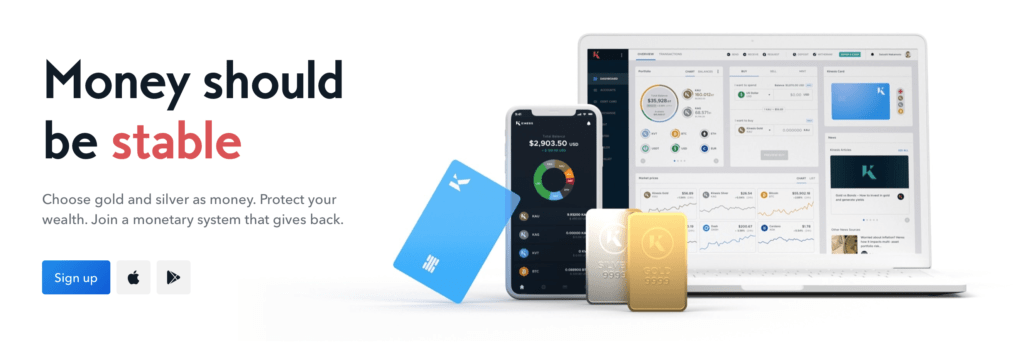

In the midst of Turkey’s economic turmoil, Kinesis.money has emerged as a solution in the financial sector. The company has established a massive, 56,000 square foot Physical Mint facility in Istanbul, marking a significant foray into the global bullion market. This facility is not just a production center; it symbolizes Kinesis’s commitment to integrating traditional financial practices with modern technology. The team at Kinesis, comprising experts in physical operations and commercial strategies, is pioneering a new era of bullion casting and minting. The recent launch of their bullion store, equipped with innovative transaction methods, signifies a paradigm shift in how precious metals are traded and perceived in the financial world.

Kinesis.money’s Digital Gold: A Modern Solution for Wealth Preservation

At the heart of Kinesis.money’s offerings is their digital gold, a blockchain-based asset that provides a novel way for individuals to safeguard their wealth against inflation. This digital gold is more than just a stable asset; it represents the fusion of timeless value with the efficiency of modern technology. The introduction of a virtual debit card, allowing for seamless gold transactions, is a game-changer. It ensures that gold, traditionally seen as a static investment, is now a fluid, easily transact-able currency. This innovation is particularly relevant in countries like Turkey, where inflation erodes traditional currency value, making Kinesis.money’s offerings not just attractive but essential.

Conclusion

The intersection of Turkey’s robust economic measures and Kinesis.money’s innovative financial solutions presents a unique narrative in the global financial landscape. In Turkey’s fight against inflation, Kinesis.money’s model stands out, offering people a secure, modern way to protect and utilize their wealth. As economies worldwide navigate similar challenges, Kinesis.money’s approach could offer a template for combining traditional financial stability with the advantages of modern technology.

Sources

- “Turkey’s Central Bank delivers another major interest rate hike” – Turkish Minute

- “Turkey’s Central Bank delivers larger-than-expected rate hike” – Al Monitor

- “The Turkish Center raises interest to 40%” – Teller Report

- “Q4 -Q1 2023 Quarterly Update | Thomas Coughlin | Kinesis Money” – Kinesis.money

- “CEO Quarterly Update | Kinesis Money” – Kinesis.money

[…] relatively unaffected by annual inflation rates. This stability makes gold an appealing option for countries like Turkey, where inflation rates have soared. Additionally, countries like Russia and China are […]