Introduction to Kinesis.money’s Role in the Digital Economy

Kinesis.money, established in 2018, symbolizes a significant shift in the digital economy, especially in Indonesia. As a revolutionary monetary system anchored in precious metals, it offers a resilient alternative to traditional inflation-prone currencies. Kinesis introduces a new form of money, leveraging the intrinsic value of gold and silver, aimed at creating a fair, transparent, and rewarding financial ecosystem.

Transaction Volume and System Resilience

The Kinesis Monetary System (KMS) utilizes Stellar’s technology, providing a high-capacity infrastructure capable of handling increasing global transactions. The Kinesis blockchain, with its immutable ledger, is pivotal in ensuring transaction security and system scalability, which are crucial for the burgeoning demands of the digital economy.

The Strength of Kinesis Monetary System

The Kinesis Monetary System (KMS) utilizes Stellar’s technology, providing a high-capacity infrastructure capable of handling increasing global transactions. The Kinesis blockchain, with its immutable ledger, is pivotal in ensuring transaction security and system scalability, which are crucial for the burgeoning demands of the digital economy.

Economic Predictions and Indonesian Wage Comparisons

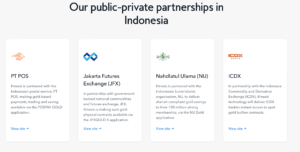

Kinesis.money’s strategic partnerships in Indonesia, particularly with the national postal service PT POS, have significantly contributed to financial inclusivity in the region. The POSPAY GOLD application, a result of this collaboration, offers Indonesian citizens accessible, low-cost options for gold trading and savings. These developments are pivotal for economic growth, aligning with President Widodo’s vision of doubling Indonesia’s GDP by 2030.

When examining the potential impact of Kinesis.money’s initiatives, it’s important to consider the varying income levels across Indonesia. While average salaries in major cities like Jakarta, Surabaya, Bandung, Medan, and Tangerang are reported to be between 535-600 US Dollars per month, there’s a stark contrast in the incomes of the unbanked or underbanked populations, which are often significantly lower. For a substantial segment of this population, particularly in rural or less developed areas, the average monthly income can be around $192. This discrepancy underscores the importance of affordable financial services and investments, like those offered by Kinesis.money, for a broader range of Indonesians.

Access to gold-based savings and payments through POSPAY GOLD could provide a valuable financial tool for both segments of the population. For those in urban areas, it offers an alternative savings and investment avenue, while for those earning lower wages, it represents an opportunity for financial inclusion and security. This dual impact could be transformative for Indonesia’s economy. By providing affordable and accessible financial services, Kinesis.money opens opportunities for wealth accumulation and financial security across diverse income groups. This approach could contribute to an overall increase in living standards and support the nation’s ambitious economic goals.

Recent Developments and Community Sentiments

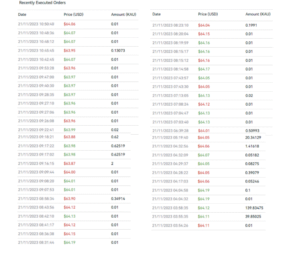

Recent discussions on the Kinesis Community Forum indicate a steady increase in transaction volumes in Indonesia, particularly following the launch of Kinesis-powered applications like POSPAY GOLD. This trend is seen as an early sign of the growing adoption and impact of Kinesis in the Indonesian digital economy. The community is keenly observing transaction patterns, especially those originating from Indonesia, as they signify local engagement with Kinesis applications.

The forum members highlight the importance of these increasing transaction volumes, considering them a key indicator of KMS’s reach and effectiveness in Indonesia. Speculative discussions about the potential economic impact of widespread Kinesis adoption provide insights into the community’s optimism regarding Kinesis’s role in Indonesia’s digital economy.

Conclusion

The Kinesis Monetary System, through platforms like POSPAY GOLD and JFXGOLD X, is emerging as a significant factor in shaping Indonesia’s digital economy. Its ability to handle high transaction volumes, offer a decentralized financial system, and potentially influence Indonesia’s economic growth are key aspects of its growing impact. As Indonesia progresses towards its ambitious economic goals, the integration of KMS with government initiatives and its role in enhancing financial inclusion will be critical in defining the country’s digital economy landscape. The Kinesis community’s increasing optimism and active engagement underscore the system’s potential in revolutionizing Indonesia’s financial sector.

Sources

- Kinesis.money About Us

- Kinesis & Indonesia Partnership

- Kinesis & JFX Launch JFXGOLD X

- Kinesis Community Forum – Indonesia Thread, Page 52

- Kinesis Community Forum – Indonesia Thread, Page 46

- Kinesis Community Forum – Indonesia Thread, Page 45