Introduction

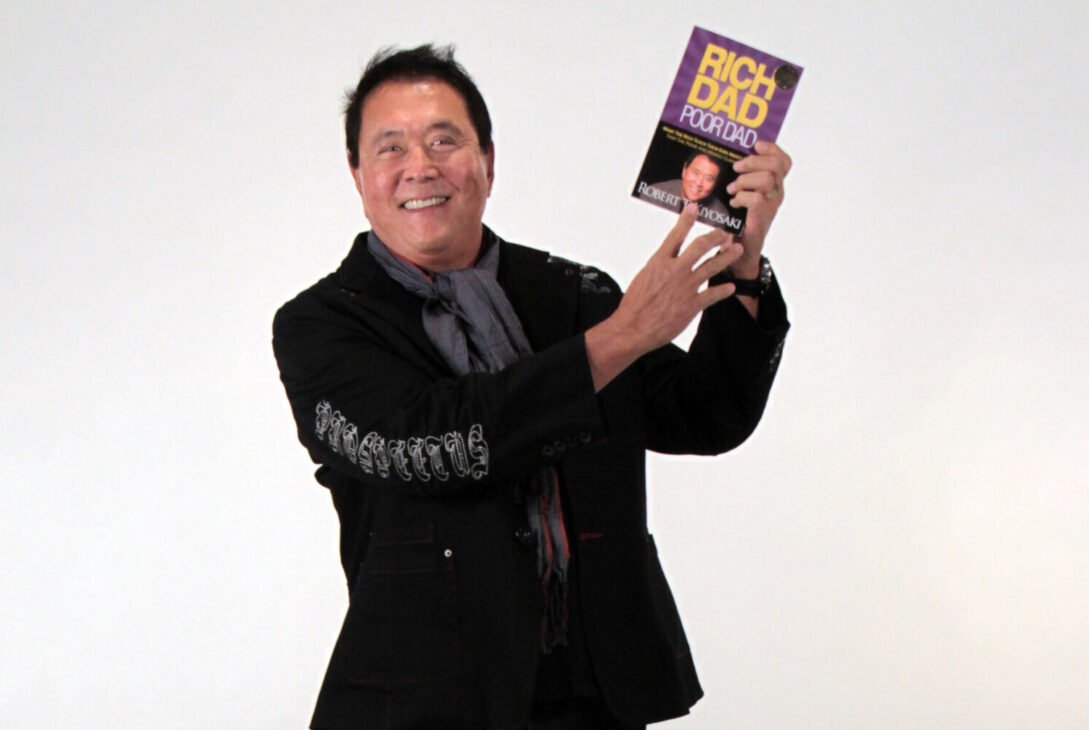

Robert Kiyosaki, the renowned author of “Rich Dad Poor Dad,” has been vocal about his support for investing in Bitcoin, gold, and silver in response to the global inflation concerns. His views reflect a growing sentiment among investors regarding the resilience of these assets in a rapidly changing financial landscape.

background

Kiyosaki’s Stance on Bitcoin, Gold, and Silver

Kiyosaki’s endorsement of Bitcoin, gold, and silver comes at a time when global living standards are threatened by worsening inflation. He has been particularly critical of fiat currencies, referring to them as a “fake money system” and urging his followers to reduce their exposure to it. Emphasizing the urgency, he stated, “Don’t be a loser. Get out of FAKE money system. Get into gold, silver, Bitcoin now… Before it’s too late”.

Criticism of Government Policies

Kiyosaki has blamed the “woke government” for the rising inflation, linking the daily struggles of people to these governmental actions. He asserts that government leaders are indifferent to public welfare, as their actions often lead to war and poverty. This criticism is intertwined with his advice to move assets from fiat to digital currencies and precious metals.

Predictions and Forecasts

In August 2023, Kiyosaki predicted that Bitcoin could reach $100,000, citing geopolitical issues as a key driver. He also envisioned a scenario where, in the event of a stock and bonds market crash, Bitcoin’s price could skyrocket to $1 million, with gold and silver prices appreciating significantly.

His views on gold and silver are particularly noteworthy. He believes silver, being an industrial precious metal growing rarer, is a better long-term investment compared to gold.

Global Economic Outlook and the U.S. Dollar

Kiyosaki’s predictions extend to the global economic landscape and the role of the U.S. dollar. He foresaw the potential announcement of a new gold-backed digital currency by the BRICS nations (Brazil, Russia, India, China, and South Africa), which he believed would significantly impact the U.S. dollar’s status as the world’s reserve currency. However, this prediction was later contradicted by Anil Sooklal, South Africa’s ambassador to BRICS, who clarified that a BRICS currency was not planned.

Despite this, Kiyosaki maintains his view on the need for diversifying investments and preparing for potential economic shifts.

Conclusion

Robert Kiyosaki’s stance on investing in Bitcoin, gold, and silver, amidst global inflation and economic uncertainties, highlights a growing trend among investors seeking alternative assets. His criticism of fiat money and government policies, coupled with his bold predictions, contribute to a broader discourse on the future of global finance and investment strategies.

References: